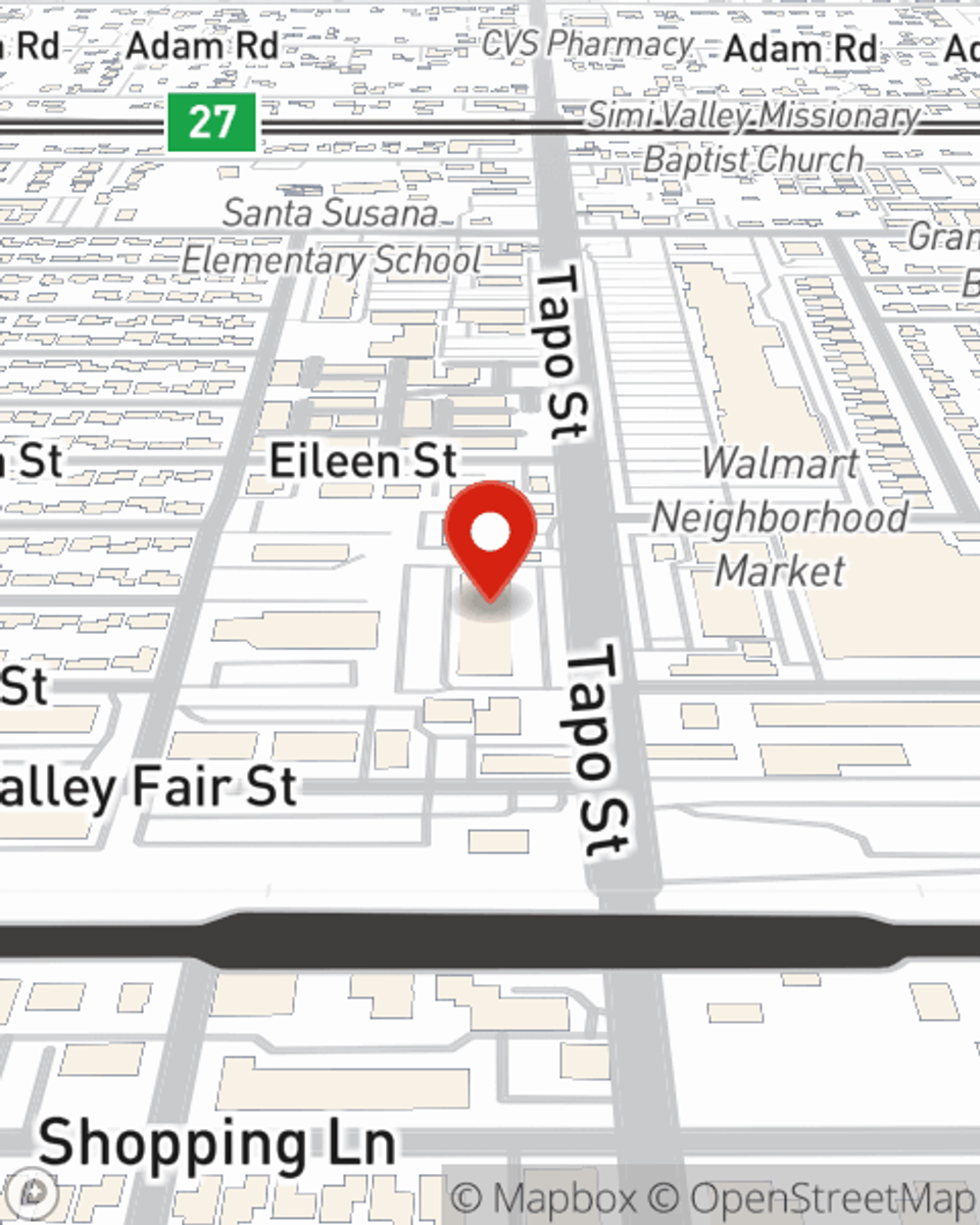

Business Insurance in and around Simi Valley

Looking for small business insurance coverage?

No funny business here

- Simi Valley

- Ventura County

- Las Vegas

- Arizona

- Nevada

- Oregon

- Moorpark

- Porter Ranch

- Southern California

- Scottsdale

- Lake Havasu

- Los Angeles

- Conejo

- Henderson

- Santa Susana

- Thousand Oaks

- Simi

- Santa Clarita

- Valencia

- Tehachapi

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, worker's compensation for your employees and business continuity plans, you can feel comfortable that your small business is properly protected.

Looking for small business insurance coverage?

No funny business here

Keep Your Business Secure

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a farm supply store, an art school or a pet store. Agent Jayson Wimmer is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Agent Jayson Wimmer is here to explore your business insurance options with you. Reach out Jayson Wimmer today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Jayson Wimmer

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.